retroactive capital gains tax september 2021

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President.

Evaluating Impact Of House Ways Means Proposal For Tax Changes

The higher rate will be effective for qualified dividends paid or sales that occur on or after September 13 2021 when the proposal was released.

. In some cases you add the. An exception to this retroactive. On The Retroactive Capital Gains Tax Hike.

On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021. Some of these provisions if enacted would have effective dates retroactive to the date the legislation was proposed September 13 2021. The current maximum 20 rate.

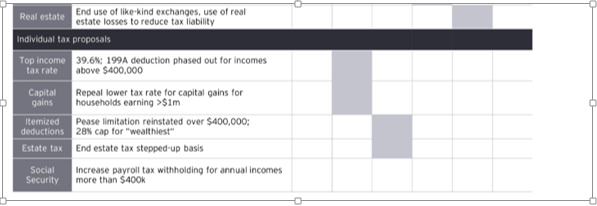

I read that it would be unconstitutional and struck down in the courts if Biden attempts to try to make his still-unpassed elimination of long-term capital gains rates. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year. The Presidents proposed 434 capital gain rate is supposed to hit only those earning 1M or more but if you bought a house 30 years ago that is now worth over 1M you.

Signed 5 August 1997. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from. Biden plans to increase this.

Effective for taxable years ending after 6 May 1997 ie for. Looking at this proposed change in the context of past changes shows that both. 7 rows Introduced 24 June 1997.

Until now the capital gain tax rate was zero 15 or 20 depending on your income. Biden wants to tax capital gains you made even before a bill passes. On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be.

A Retroactive Capital Gains Tax Increase. A retroactive to April or May of 2021 increase in long-term capital. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021.

Team Biden apparently wants to visit similar retroactive tax joy on families this year. The long term capital gain tax is graduated 0 on income up to 40000 15 over 40000 up to 441450 and 20 on income over 441451 in some cases add the 38 Obamacare tax. Reduced the maximum capital gains rate from 28 percent to 20 percent.

2021 637 pm ET. Some of these provisions if. The capital gains tax increase as of September 13 2021 there are no retroactive taxes in the proposal affecting individuals estates or trusts.

The treatment of gifts at death as sales that require capital gains tax to be paid on amounts over 1 million. Are retroactive tax increases constitutional or even fair. The later in the year that a.

September 07 2021 Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical. President Bidens proposal to increase the capital gains tax has generated tremendous discussion.

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Tax Changes For 2022 Kiplinger

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Critics Sound The Alarm Ahead Of Possible Retroactive Capital Gains Tax Hike

Advisors Look For Ways To Offset Biden S Retroactive Capital Gains Tax Hike

Be Ready For Big Changes 2021 Tax Planning

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Estate Taxes Under Biden Administration May See Changes

Biden S Proposed Retroactive Capital Gains Tax Increase

If The Democratic Tax Bill Passes Will It Be Retroactive To January 1 2021 Articles Advisor Perspectives

Biden Tax Plan Forecast To Bring In 3 6t In Decade Investmentnews

Managing Tax Rate Uncertainty Russell Investments

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Capital Gains Tax Hike And More May Come Just After Labor Day

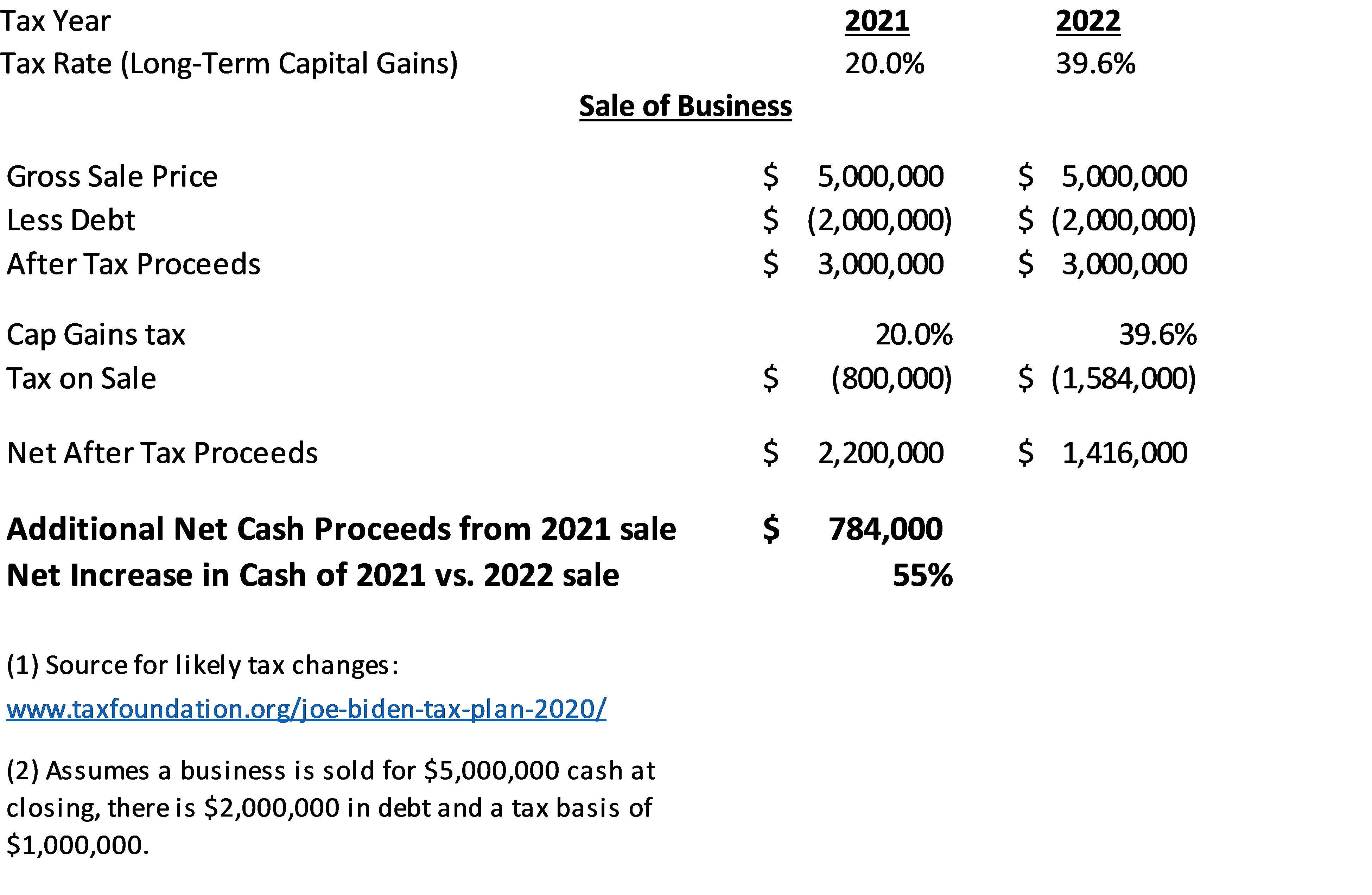

Time Is Running Out Close Before December 31st 2021 For Potentially Significant Tax Savings Newbridge Group

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Restricting The Step Up In Basis Tax Loophole Would Hit Heirs To Houses And Retirement Portfolios Whose Value Has Swelled Over The Years Financial Planning

Estate Planning In A Biden Administration Denha Associates Pllc