michigan unemployment income tax refund

If you received unemployment benefits in 2020 a tax refund may be on its way to you. On Form 1099-G.

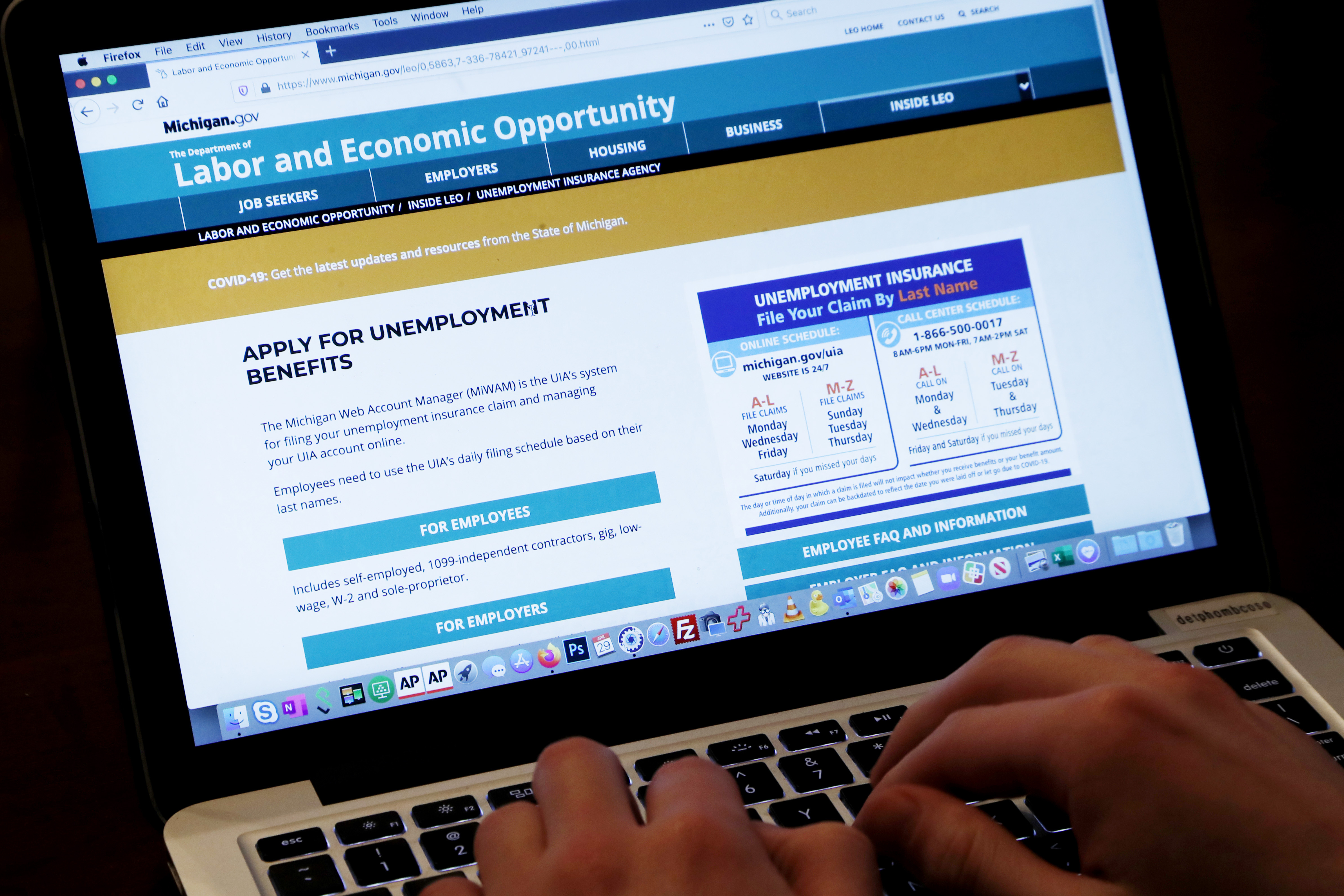

Michigan Finally Releases Tax Forms For Those Who Were Jobless In 2021

Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your personal data then press Submit.

. If you entered your information correctly youll be taken to a. The refunds are only for people with a gross income under 150000 and only counts toward the first 10200 of unemployment earnings in 2020. You may also call 1-517-636-4486.

Please allow the appropriate time to pass before checking your refund status. In Box 4 you will see the amount of federal income tax that was withheld. Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back.

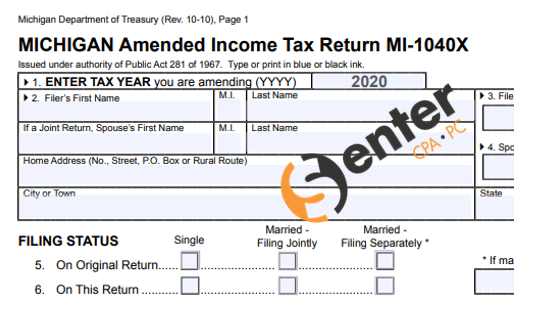

The Michigan Department of Treasury is urging taxpayers to file amended Michigan individual income tax returns if they have already filed without reporting unemployment compensation. However you dont pay tax in Michigan on. Allow two weeks from the date you.

The IRS has sent 87 million unemployment compensation refunds so far. Allow 2 weeks from the date you received confirmation that your e-filed state return was. The rule change only.

In Box 1 you will see the total amount of unemployment benefits you received. Before starting this process please. Total Household Resources are found on line 33 of your MI-1040CR or line 34 of your MI-1040CR-7.

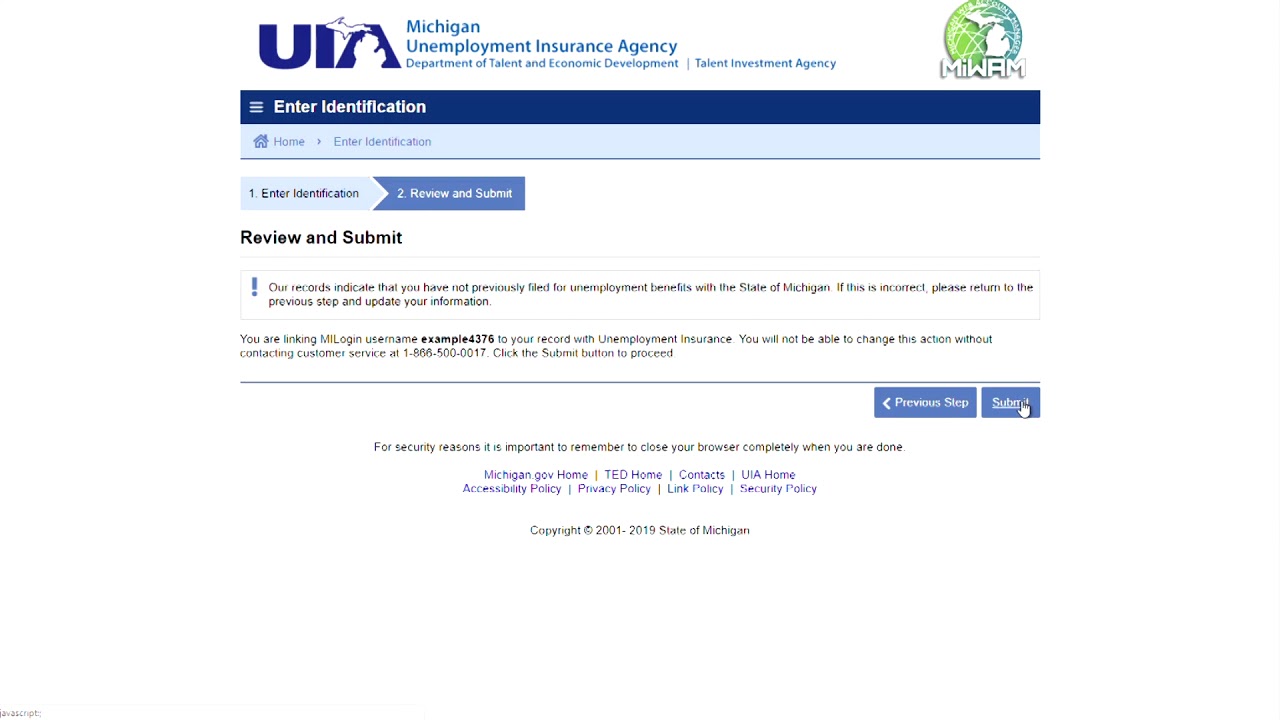

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Michigan State Married Filing Jointly Filer Tax Rates Thresholds and Settings. You received a letter from the Michigan Department of Treasury directing you to this web site to confirm your identity or identify the return as suspicious.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. Michigan State Single Filer Personal Income Tax Rates and Thresholds in 2023.

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

At Least 7 Million Americans In Line For Unemployment Tax Refunds

Mi Treasury Waives Tax Penalties Interest Related To Unemployment Benefits Wzzm13 Com

Michigan Income Verification R Unemployment

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Irs Issues 510 Million In Refunds To Taxpayers Who Overpaid On Unemployment

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

Creating Your Milogin Account Youtube

State Pushes Back Release Of Unemployment Aid Tax Forms

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Judge Orders State To Stop Seizing Allegedly Overpaid Unemployment Benefits

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Michigan S Uia Pauses Collections For Those With Overpayment Letters

Mi Oficina Income Tax Insurance File Your Taxes With Mi Oficina Income Tax And Get The Maximum Refund Fast This Year You Will Qualify For Additional Credits If You